Key Takeaways

- The Trump family is in talks to invest in Binance.US, with potential stakes through their venture World Liberty Financial.

- Changpeng Zhao seeks a pardon to aid Binance’s US market return, following his previous imprisonment and fines for violations.

Share this article

President Trump’s family is negotiating a stake in Binance.US, a move that could deepen their involvement in the crypto industry, according to a Thursday report from the Wall Street Journal, citing people with knowledge of the discussions.

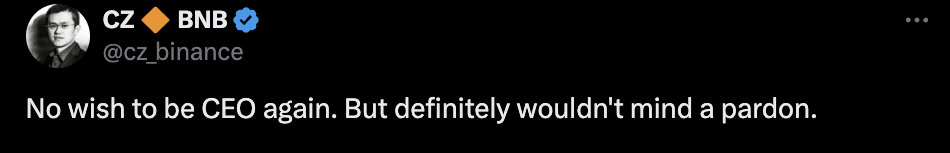

At the same time, Changpeng “CZ” Zhao, Binance’s founder, has been lobbying for a pardon from President Trump after serving prison time for regulatory violations, the report stated.

CZ had previously expressed openness to receiving clemency from the Trump administration. In a now-deleted December 2 post on X, the founder of Binance stated that he “wouldn’t mind a pardon” from Trump but insisted that he had no intention of returning as Binance’s CEO.

The discussions began after Binance approached Trump allies last year, offering a business deal with the family as part of its strategy to return to the US market. The potential stake could be held directly by the Trumps or through World Liberty Financial, their crypto venture launched in September.

Steve Witkoff, Trump’s chief negotiator for Middle East and Ukraine matters, has been involved in the discussions, according to some people familiar with the situation. However, an administration official denied Witkoff’s involvement and said he is divesting from his business interests.

Binance, which agreed to pay $4.3 billion in fines in 2023 to settle anti-money laundering violations, sees a pardon for Zhao as crucial for its US market return. Zhao, who served four months in prison after pleading guilty to related charges, remains Binance’s largest shareholder and currently resides in Abu Dhabi.

The UAE state-backed investor MGX recently acquired a minority stake in Binance for $2 billion, marking the exchange’s first institutional investment.

For Binance.US, which was valued at $4.5 billion in 2022, the deal comes as its market share has declined from 27% to just over 1%. US officials previously said the exchange facilitated transactions with sanctioned groups and encouraged US users to hide their location to avoid compliance requirements.

The talks have continued since Trump’s inauguration, according to people familiar with the discussions. Last month, the SEC requested a court pause its civil case against Binance and Binance.US while developing a regulatory framework for crypto assets.

Story in development.

Share this article