The Bank of Korea has stated that it is approaching the idea of including Bitcoin in its foreign exchange reserves with caution, citing concerns over the cryptocurrency’s extreme price volatility.

In a 16 March 2025 response to a written inquiry, central bank officials confirmed that they have neither discussed nor reviewed the possibility of adding Bitcoin to South Korea’s foreign reserves.

Their response came after Representative Cha Gyu-geun of the National Assembly’s Planning and Finance Committee raised the issue. According to reports from The Korea Herald, the central bank stressed that a “cautious approach is needed.”

EXPLORE: 10 Coins with High Returns: Crypto Forecast 2025

Bitcoin’s Volatility Raises Concerns

The Bank of Korea pointed to Bitcoin’s unpredictable price swings as a major concern. Officials noted that in times of market instability, transaction costs to liquidate Bitcoin could increase sharply, making it a risky asset for foreign reserves.

Over the past 30 days, Bitcoin’s price has fluctuated between $98,000 and $76,000 before stabilizing around $83,000—a 15% decline since February 16, according to CoinGecko.

The discussion surrounding Bitcoin as a reserve asset has gained momentum globally, particularly after U.S. President Donald Trump’s recent executive order establishing a strategic Bitcoin reserve and digital asset stockpile.

At a seminar on March 6, crypto industry lobbyists and some members of Korea’s Democratic Party urged the government to consider integrating Bitcoin into its national reserves and to develop a won-backed stablecoin.

However, the Bank of Korea remains firm on its reserve asset criteria, emphasizing that foreign exchange holdings must be liquid, readily accessible, and have an investment-grade credit rating—requirements it believes Bitcoin does not meet.

NEW:

North Korea joins the Strategic Bitcoin Reserve Race.

– BTC held: 13,562 pic.twitter.com/Ybru2wpfu4

— Fiat Archive (@fiatarchive) March 17, 2025

Professor Yang Jun-seok of Catholic University of Korea agreed with the central bank’s stance, stating that foreign reserves should be allocated based on the currencies of major trading partners.

Meanwhile, Professor Kang Tae-soo of KAIST’s Graduate School of Finance suggested that the U.S. is more likely to leverage stablecoins rather than Bitcoin to maintain dollar dominance.

He added that the International Monetary Fund’s (IMF) recognition of stablecoins as official reserves could significantly impact future monetary policies.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

South Korea Confirms New Regulation For Institutional Crypto Investments By Q3

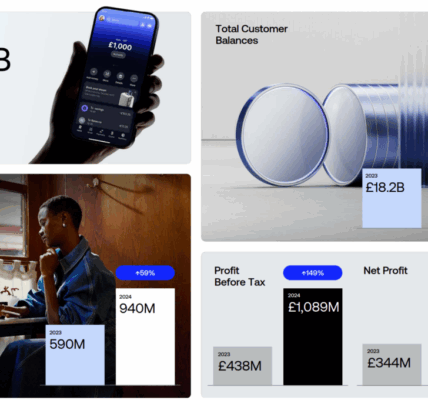

Last week, South Korea’s Financial Services Commission (FSC) announced plans to issue comprehensive guidelines for institutional cryptocurrency investment by the third quarter of 2025.

The FSC revealed its roadmap during a meeting with local crypto industry experts on Wednesday, 12 March 2025.

Recently, the country also revealed that its crypto rules could change as the government plans to lift the corporate crypto trading ban, paving the way for Korean crypto capital.

On 13 February 2025, the country announced that it is lifting its long-standing crypto trading ban. The decision has now made it possible for institutions, non-profits, and other corporate entities to engage in crypto transactions in the country.

EXPLORE: 10 Best AI Crypto Coins to Invest in 2025

Key Takeaways

- The Bank of Korea remains cautious about adding Bitcoin to its foreign reserves due to its high volatility.

- Officials emphasize that reserve assets must be liquid, accessible, and investment-grade, criteria Bitcoin does not meet.

- Meanwhile, South Korea is moving toward institutional crypto adoption by lifting its corporate trading ban.

The post Bank Of Korea Takes Cautious Stance On Bitcoin As Reserve appeared first on 99Bitcoins.