Main Takeaways:-

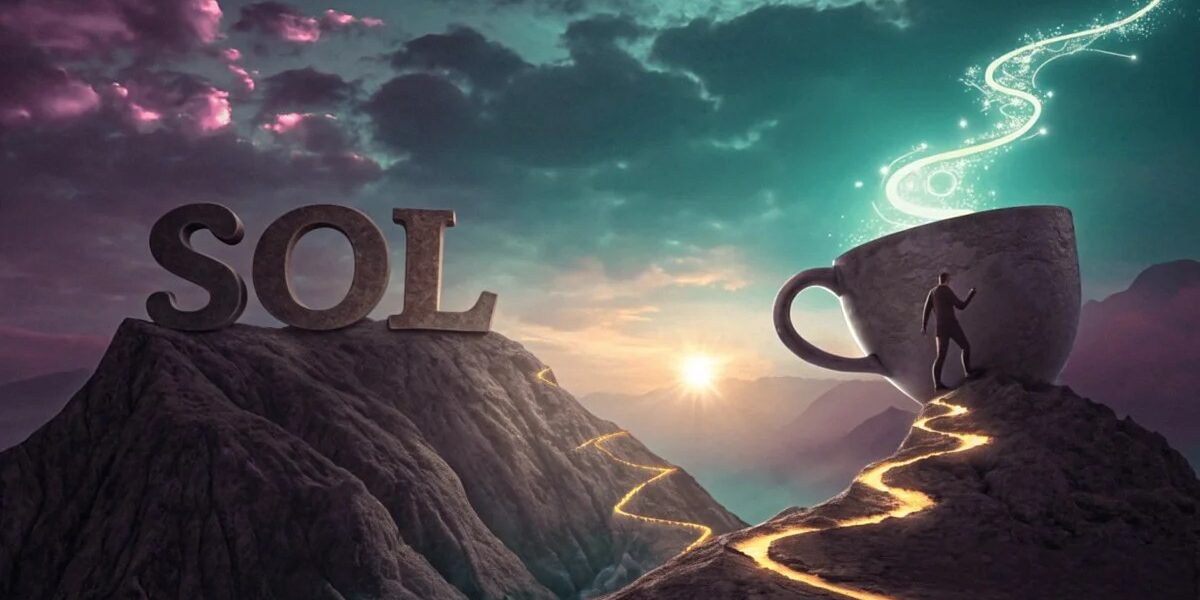

- Solana is showing a “cup-and-handle” chart pattern, which often suggests a possible price increase. At the same time, most traders on Binance are betting that the price will go up.

- Feelings and online activity around Solana are still low, showing that people are being careful, even though the charts suggest the price might go up.

Solana (SOL) is creating a textbook cup-and-handle pattern in the weekly chart. At present, the price is testing the neckline resistance between $200 and $210 following a rebound from $135.

At the time of reporting, SOL traded at $170.20, pointing to a 1.57% decline in the past 24 hours. Even though the price dropped a little, the chart pattern stayed strong, and buyers are still trying to push the price above the downward trendline.

So, if the price clearly moves above $200, it could lead to a strong upward move and confirm that the trend is turning bullish.

Neutral Trading Activity Edges Toward Outflows

Exchange flow data from the 16th of May indicates $148.49M in inflows and $149.55M in outflows. This small difference between the two metrics indicates that selling pressure is still down.

So, most investors seemed to be keeping their investments instead of selling them.

This kind of behaviour usually helps support a price increase, especially when the price is close to a key barrier. But since there aren’t many people pulling their money out, it shows that confidence is still low.

As a result, Solana may need stronger assumption signals to support a breakout over the psychological $200 level.

Dominant Long Bias Highlights Bullish Trader Sentiment

Binance data indicates that 70.53% of traders currently hold long positions at the reporting time, with a Long/Short Ratio of 2.39. This big difference shows that people expect the price to go up even more.

That kind of positioning can help prices rise quickly when they break out. But it also means the market could suddenly drop if prices go the other way, causing many investors to be forced to sell.

Even though there’s a risk, the fact that most traders are betting on prices going up shows they are confident. So, if the price goes above $200, it could rise even faster because more investors might jump in, and those betting against it may be forced to buy, pushing the price up more.

But people’s overall feelings about Solana are still slightly negative, with a sentiment score of -0.46. This means most traders are still being careful. Even though the price chart looks strong, most people have not started feeling positive yet.

In the past, price increases that started when most people were feeling negative often continued for a longer time.

Retail backs down?

Interest in social media has gone down, and fewer people are interacting. Trading volume was 162, and its share of the market fell to 3.74%.

These figures indicated that Solana was no longer the centre of focus of retail interest. Yet, this lack of attention could work to its benefit.

Price usually goes up when there is little confusion or distraction. But since not many people are interested right now, the big price jump might take longer. If more people start talking about it on social media, that would show stronger belief, but for now, interest is low.

In the end, SOL looks like it has a good chance to go up because of a clear chart pattern called a cup-and-handle, and many traders are betting on the price going higher.

Yet, broader market actions still mixed, with lower sofeelingslume and small negative feelings indicating low broad support.

Read also:- After the Climb: What’s Next for Dogecoin at $0.22?

Disclaimer: We at Bitcoinik.com present you with the latest information in the crypto market. However, this information should not be regarded as financial advice, and viewers should consult their financial advisors before investing.