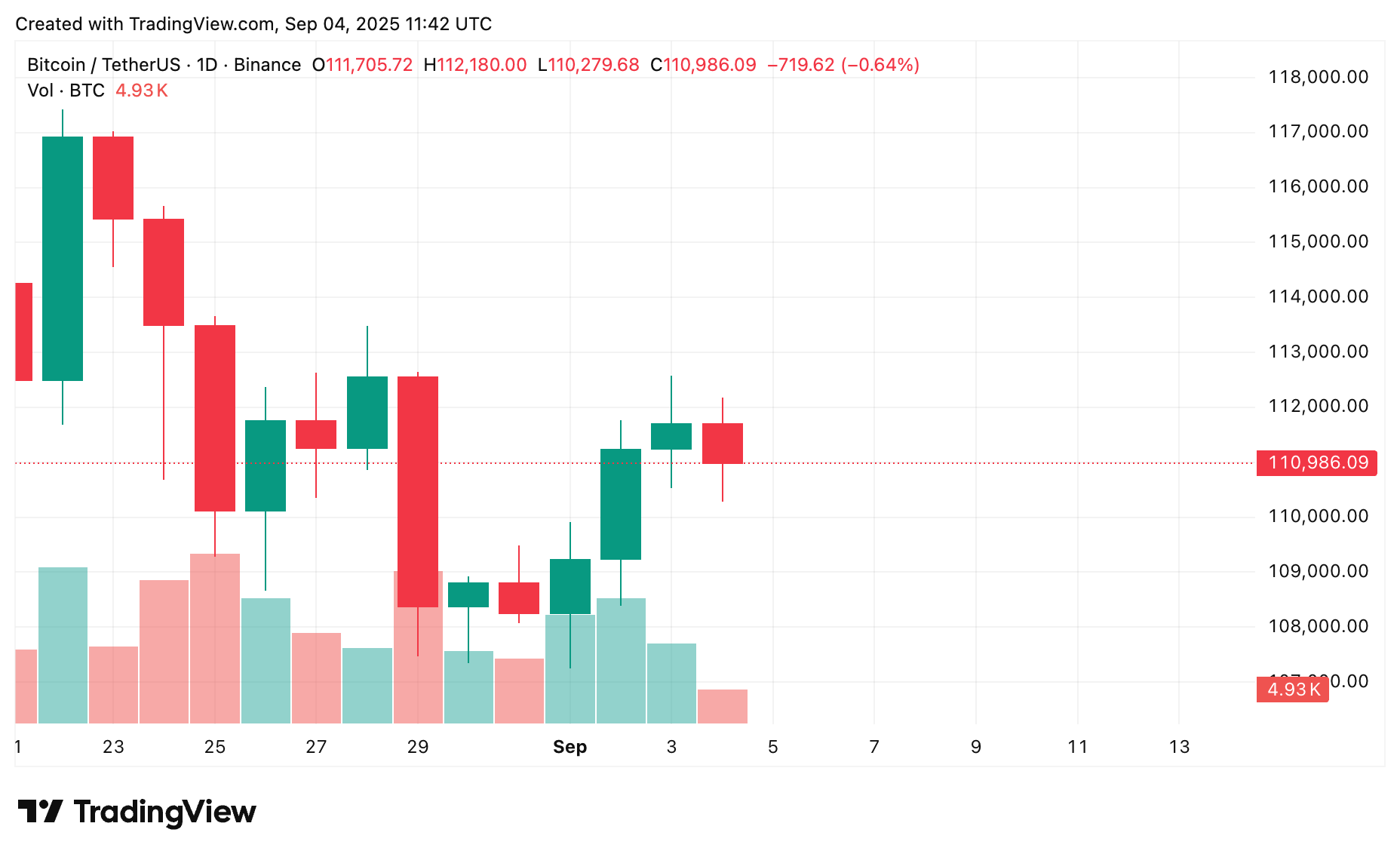

Bitcoin is holding steady around $110,900 today after a choppy August filled with price swings and macroeconomic jitters impacting the current Bitcoin price prediction.

Things seem to be settling down, with sentiment improving on the back of ETF inflows, a more optimistic macro picture, and increased action in the derivatives market. Traders are watching $112K as a key resistance level, and $108K as nearby support, as Bitcoin trades in a tight range.

So, what’s the Bitcoin outlook going forward?

Summary

- BTC holds steady around $110,900 after a volatile August, with $112K resistance and $108K support in focus.

- ETF inflows and stablecoin liquidity are supporting price stability and improving sentiment.

- A break above $112K could trigger a rally toward $116K–$118K, especially with bullish macro data.

- A drop below $108K risks downside to $104K or even $100K, as volatility builds.

- Bitcoin price prediction remains cautiously bullish, with institutional flows and macro signals key to next move.

Current BTC price scenario

At the moment, Bitcoin is trading in a tight range between $110.3K and $112K, supported by growing stablecoin liquidity and rising optimism around Bitcoin ETFs.

There’s also a lot happening in the derivatives space — open interest is sitting around $114 billion, which points to plenty of speculative action. Traders are especially watching the $110K and $112.2K levels, where liquidation clusters have built up, marking key pressure points.

Normally, September’s not great for Bitcoin (hence the name “Red September”), but this year might not follow the usual script. More institutions are getting in through ETFs, and that could change how the month plays out.

Positive impact on Bitcoin price

If Bitcoin (BTC) breaks decisively above $112K, we might see a strong rally pushing prices up to $116K–$118K, likely fueled by more speculative inflows, especially from institutions tied to ETF products.

Bitcoin ETF inflows are now almost matching those of big gold ETFs, signaling a big shift in how institutional investors are playing the game. These steady inflows could keep the price climbing, especially if the macro picture stays positive.

Also, a better-than-expected U.S. jobs report could raise expectations for a Fed rate cut, adding extra fuel to Bitcoin’s rally. That could drive up risk appetite and bring more money into crypto in the near term.

Negative impact

If Bitcoin fails to breach the $112K level, the risk of a pullback increases. A retracement toward the $108K support is the immediate concern, and if bearish sentiment intensifies, a further decline toward the $104K–$105K range cannot be ruled out.

The historical risk of September weakness adds another layer of caution. Traders are increasingly hedging against volatility, as shown by options market data and rising implied volatility metrics. This suggests the market is preparing for sharp moves in either direction.

With liquidation risk zones forming just above and below current prices, Bitcoin is in a precarious spot. A minor catalyst — positive or negative — could trigger significant price action.

Bitcoin price prediction based on current levels

The key range to monitor in the short term is $108K–$112K.

- If Bitcoin clears $112K, it might launch a strong rally heading toward $116K or even $118K — especially if ETFs keep pulling in funds and the market stays healthy.

- Conversely, dropping below $108K could open the door to a move down to $104K, with $100K as the next major support.

For now, the Bitcoin price prediction is staying on the cautious side while everyone waits for more definite signs from the economy and institutional flows. One thing’s for sure though — volatility is likely to ramp up as Bitcoin nears this important turning point.

Basically, the BTC price forecast depends on what happens next in this narrow range. The medium-term projection leans bullish because institutions are stepping up, but traders should expect a few hiccups with seasonal and macro challenges in the mix.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.