Ray Dalio Breaks Down US Dollar Decline as Crypto Strengthens Reserve Potential

The threat to the U.S. dollar’s reserve currency status is accelerating a flight to crypto and gold, underscoring deepening fiscal cracks spotlighted by Bridgewater Associates founder Ray Dalio. Ray Dalio Calls out Fiscal Pressure on US Dollar—Why Crypto Is Benefiting…

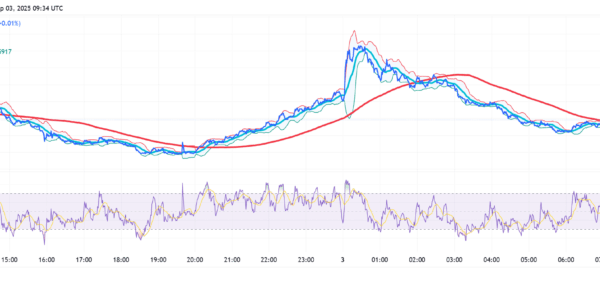

Will $0.00001 hold after whale offloading?

Summary The price dropped to test the crucial $0.00001 support level as a whale offloaded over 500B PEPE (~$4.8M). PEPE is currently trading between $0.0000097 and $0.0000098. Holding the $0.00001 pivot, which is still crucial for a bullish PEPE price…

Polymarket CEO confirms readiness to launch in US after CFTC event contract ruling

Key Takeaways Polymarket is set to launch US operations after the CFTC issued a no-action letter regarding event contracts. The company’s $112 million acquisition of QCEX’s holding company establishes Polymarket US and Polymarket Clearing for regulated prediction contract trading. Share…

SEC Chair Backs Market Freedom in Spot Crypto Trading With Joint CFTC Support

Powerful statements from top U.S. regulators signal a dramatic pivot toward crypto freedom, embracing innovation, market choice, and a unified push to reclaim global leadership. SEC Chair Pushes for Trading Freedom in Joint Crypto Regulation With CFTC U.S. Securities and…

Gemini IPO Targets $317M as Trump Media Bets $1B on Crypto.com Treasury Strategy

Gemini Space Station Inc., the crypto exchange founded by Cameron and Tyler Winklevoss, has filed for a $316.7M initial public offering (IPO) in New York. Social media is dubbing it the “Gemini IPO” and the company plans to sell 16.7…

VivoPower Unveils $30M XRP Yield Program With Doppler, Plans $200M Expansion

Nasdaq-listed VivoPower International has entered the XRP finance sector with a $30 million treasury deployment through Doppler Finance, marking the first phase of a broader $200 million allocation plan. The move positions the energy solutions company as one of the…

Company Focused on Bringing Ethereum to Wall Street Raises $40 Million

Etherealize has closed a $40 million funding round to develop Ethereum-based infrastructure for institutional finance. The investment was led by venture firms Electric Capital and Paradigm. $40M Investment to Fund Development of Ethereum Trading, Settlement Systems According to the announcement,…

Can institutional support battle rate pressure?

Summary XRP is hovering around $2.85, struggling to gain traction as macroeconomic uncertainty weighs across crypto. Institutional demand is igniting optimism—CME XRP futures have topped $1 billion in open interest, signaling renewed faith from institutional players. However, bullish momentum remains…

How to cut through the noise in crypto prop trading

Share this article You’ve honed your strategy, you understand market dynamics, and you’re ready to trade with more significant capital. The world of proprietary trading offers a compelling path forward, but entering the crypto prop space often feels like stepping…

The DAT Shift: What’s Pulling Biotech Firms Into the Crypto Treasury Game?

2025 has shaped up to be a defining year for the emerging digital asset treasury movement, widely referred to as DATs. Research indicates that more than 100 publicly traded firms have embraced the DAT strategy, with a significant portion of…