Solana-based decentralized exchanges reportedly handled more trading volume than giants like Binance and Bybit for stretches of late 2025, shifting more crypto price discovery directly onto the blockchain.

While SOL has traded in a wide range this year, on-chain activity and volumes on Solana DEXes, such as Jupiter, Orca, and Raydium, continue to hit new records. This happens as traders look for faster, cheaper venues, and institutions route more activity into crypto ETFs and tokenized assets.

What Does Solana’s DEX Surge Actually Mean For Everyday Traders?

A DEX (decentralized exchange) is like a self-service crypto swap machine that lives on a blockchain. Instead of sending coins to a company like Binance, you trade directly from your wallet using smart contracts. On Solana, DEXes such as Jupiter, Orca, and Raydium now process enough trades to rival – and at times beat – the spot volume of top centralized exchanges (CEXes).

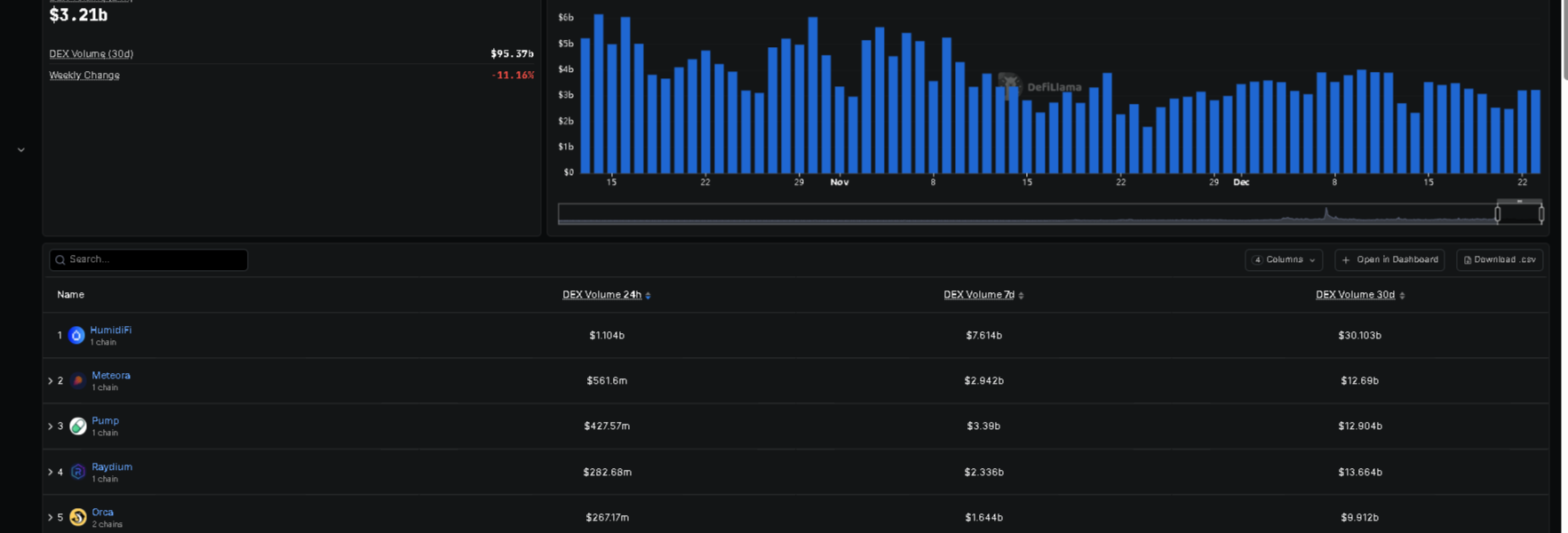

Solana DEX volume has consistently matched or surpassed that of major CEX spot volumes during the final quarter of 2025. Other data backs this trend: Raydium cleared over $100 billion in monthly volume for three months in a row, and total Solana DEX volume climbed above $120 billion in some months, keeping a multi‑month lead over Ethereum DEXes.

Why should you care? Because where the volume goes, better prices and liquidity usually follow. If most SOL and stablecoin trading happens on-chain, then slippage and spreads often improve there first. That affects how much you actually receive when you swap tokens, not just the headline price on a chart.

DISCOVER: Top Solana Meme Coins to Buy in 2025

How Is Solana Pulling This Off Compared With Ethereum and Exchanges?

Solana’s pitch is simple: speed and low fees. Think of Ethereum as a busy downtown road at rush hour and Solana as a multi-lane highway with cheaper tolls. After the Alpenglow upgrade, Solana achieved transaction finality under 100 milliseconds, which attracted high-frequency trading firms and algorithmic traders that require instant settlement. When those players move, they bring a significant amount of volume.

After monitoring the Alpenglow testnet this month, sub-100ms finality appears achievable in practice. By replacing TowerBFT with the Votor consensus protocol, Solana can finalize blocks in a single voting round, materially reducing settlement latency.

Stablecoin inflows matter too. In one recent month, more than $5.5 billion in USDC minted directly on Solana created a kind of “permanent bid” for on-chain trading. That lets traders route orders through Solana DEXes and save an estimated 0.10–1% per trade versus some centralized venues, thanks to lower fees and tighter spreads. Daily Solana DEX volume even exceeded $3.8 billion at times, beating Ethereum and Base combined.

Institutions add another layer. Spot Solana ETFs in the US and Europe reportedly manage over $2 billion and rebalance using Solana’s own rails, not hidden “dark pools”. That turns Solana from a “fast chain” into a full trading hub for both retail and professional money. If you follow institutional adoption stories, such as on-chain financial instruments on Solana or Visa’s USDC settlement on Solana, this trend fits right in.

Centralized exchanges are not ignoring this. Bybit incubated a native Solana DEX called Byreal to recapture the on-chain volume, while Binance ramped up support for Solana DeFi. Even big CEX brands now treat DEXs on Solana as the place “where the trading happens” in this cycle.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

What Are the Risks for New Solana and DeFi Users?

This shift sounds bullish, but you still face real risks. Solana’s DEX boom rode a huge memecoin wave in early 2025, and weekly volume in that segment dropped by around 95% from its peak. Total Value Locked (the total assets parked in Solana DeFi apps) slid over 30% in December to around $8.7 billion as traders took profits and rotated elsewhere. High usage does not guarantee token prices will keep rising.

On-chain trading also removes the safety net of a customer support desk. When you use a DEX, you approve transactions from your own wallet. If you click the wrong token, fall for a fake link, or invest in a hype coin that later loses value, there is no “undo” button and no chargeback. Treat DeFi like self-driving finance: powerful and convenient, but you take the wheel.

The good news is that Solana’s uptime has improved to over 99.9%, with approximately 98 million monthly active users, which helps build trust. But smart contract bugs, scam tokens, and rug pulls still exist, especially on trending chains. If you explore Solana DEXes after reading this, start small, double‑check contract addresses, and never trade with money you need for rent or bills.

If this shift holds into 2026, more of crypto’s “real” prices and liquidity may live on Solana and other DEX-first networks, not on centralized order books. For everyday users, that opens access to faster and cheaper trading—but only if you pair curiosity with strict self-protection rules.

To see how centralized venues respond, you can watch moves like Coinbase’s expansion of Solana trading or CME’s Solana futures. If on-chain volume keeps growing, your “default” trading venue in a few years might be a Solana DEX tab in your wallet, not a centralized exchange website.

DISCOVER: 20+ Next Crypto to Explode in 2025

The post Solana DEXes Just Out-Traded Binance: What It Means for You appeared first on 99Bitcoins.