As Bitcoin adoption grows, the base layer is becoming increasingly expensive and more technically challenging. Block space is scarce, and fees are always expected to rise.

Onboarding directly into self-custodial Bitcoin also requires unintuitive background knowledge in Bitcoin such as UTXO management, blind signing, monitoring mempool, liquidity management, fee rate calculation, etc.

At the same time, new users—especially in developing regions—are eager to experience Bitcoin’s full potential, whether as an ultra-fast payment method through the Lightning Network or as a resilient and trustless store of value.

The more practical solution is to receive or buy bitcoin-backed certificates issued by a trusted entity (preferably a private one), which can be converted into real bitcoin once the user reaches an acceptable threshold of custodial counterparty risk.

These tokens take many forms: account balances on Lightning network exchanges, bearer tokens like eCash issued by mints, others issued by federated sidechains, or even bitcoin tokenized on Altcoin networks.

TradFi tokens like ETFs for example, track the price of bitcoin and can be exchanged with fiat but don’t allow you to withdraw to self-custody.

Which leads to the obvious (and very valid) question: Are All Bitcoin Tokens Shitcoins?

What is a bitcoin I-Owe-You Token exactly?

A bitcoin IOU is any off-chain representation of bitcoin. It’s not a UTXO you control with your keys. It’s a promise. Not your keys, not your bitcoin.

An IOU is like a bitcoin in a Schrödinger’s cat scenario: it may or may not exist until you initiate a withdrawal to your self-custodial vault and pay actual mainnet fees. Only then do you gain certainty about whether it truly exists.

Even though they are not bitcoin, these tokens can differ from each other massively in how they work and what trust, security, or settlement assurances they give you. Some are closer to real bitcoin than others.

Some Are Definitely Shitcoins!

Let’s be honest — some bitcoin tokens are just garbage. If the token:

- Can’t ever be redeemed for real bitcoin

- Can’t be moved freely between users (no Lightning)

- Doesn’t offer privacy or auditability,

then you’re holding a bitcoin-flavored fiat product, not bitcoin.

Unlike a balance on a Bitcoin-Lightning exchange such as Strike, ETFs, for example, offer no onchain withdrawals. They lock you in fiat settlement systems and function more like stocks than digital money.

WBTC on Ethereum may be programmable, but it can’t travel through Lightning to settle with other bitcoin custodians cheaply or quickly.

So yes — some bitcoin tokens are shitcoins.

But Some Are Genuinely Useful!

Custodian-issued Lightning tokens allow users to:

- Pay and settle real Lightning invoices (HTLCs)

- Move balances between custodians to diversify counterparty risk,

- Escape one custodian if there’s a rumor of insolvency via the Lightning network for small amounts, and via on-chain for bigger ones.

They’re global, fast, many are permissionless, interoperable, and redeemable. They help new users accumulate until they can afford full trustless self-custody. That’s not shitcoin — that’s a stepping stone, a fun way to introduce newcomers to Bitcoin and progressive custody.

Open-source lightning custodian applications like Coinos and Blink offer a solid Bitcoin experience for newbies, plebs, and merchants.

Coinos can also be accessed through the newly-released Cypher Box wallet, and funds can be withdrawn with a click of a button to hot storage, and then another button to consolidate and batch multiple UTXO coins into cold storage.

E-Cash mints (like Cashu or Fedimint) provide high privacy and bearer-style portability.

While they’re harder to audit, they offer a valuable service in adversarial environments — and ongoing research into Proof-of-Liabilities, such as publishing mint and burn proofs with periodic key rotations, aims to improve transparency without sacrificing privacy.

Zeus has recently integrated eCash support into their non-custodial Lightning wallet.

Some are Highly Reliable

L-BTC on the Liquid sidechain is one of the most fascinating ones. Because it’s not just an ordinary sidechain controlled by a multisig federation. It’s one that is interoperable (through noncustodial swaps) with the Lightning Network, the fastest most decentralized L2 network in crypto.

Liquid is an auditable tamper-evident chain that allows you to run your own node and audit the total supply of L-BTC in comparison to the amount of real bitcoin that the federation holds on your behalf stored in their public Bitcoin address.

It also supports confidential transactions and the ability to swap out to hot or cold storage. Many wallets support Liquid, such as Aqua, and Misty Breez. Blitz wallet can turn your L-BTC to a noncustodial lightning channel at a 500K-sat threshold, giving you real bitcoin ownership.

The Trade-offs: Censorship vs. Reliability

Bitcoin tokens also exist on a spectrum between censorship resistance and legal reliability:

ETFs and regulated exchanges are hard to rug without legal accountability — but easy to censor and confiscate.

Also, regulation doesn’t always guarantee safety. FTX was regulated, but it still left users holding an IOU, after years of lawsuits and drama, they could finally redeem it — but not at bitcoin’s current price.

Private mints or pseudonymous custodians offer privacy — but might disappear tomorrow. A marketplace of such custodians may reduce this risk substantially.

Certain custodians and federations might offer the best of both worlds.

What Sets the Better Bitcoin Tokens Apart is Escapeability. Can you get out — quickly, cheaply, and into real bitcoin?

Lightning IOUs shine here where you can:

- Send funds to another custodian (convert into a different IOU),

- Swap out to self-custody via submarine swaps,

- Redeem on-chain when the amount justifies the fee

That’s not a shitcoin. That’s liquidity, portability, and optionality.

Tokens that are stuck in one ecosystem — or redeemable only for fiat — are brittle. They can’t be used to flee collapsing systems, protect privacy, or help you progress to full sovereignty.

So… Are All Bitcoin Tokens Shitcoins?

No. Some are just wrappers for bitcoin exposure — with no path to freedom. Some are speculative instruments — unable to settle or transact with anyone.

But others—especially Lightning-compatible ones and auditable federated systems—are part of Bitcoin’s circular economy.

In a high-fee world, most new users will have to onboard and accumulate off-chain first. The key is to understand:

- What kind of token are you sending to your newbie friend?

- What networks does it support?

- How easily can your friend exit?

- Are there any legal guarantees?

- Does it protect their data and privacy?

- Does it have a solid reputation and history?

Once you assess all the tradeoffs;

- Provide them with a subjective threshold range to confidently hold a balance of this token (e.g., 500,000 to 2 million sats), beyond which they should consider upgrading to a more secure custody solution like a hot wallet.

- Advise them to diversify by holding tokens issued by different entities and creating multiple Lightning accounts to spread counterparty risk.

The best bitcoin tokens help people progress toward self-custody. The worst trap them in walled gardens.

So no — not all bitcoin IOUs are shitcoins. But every IOU demands scrutiny. That’s why I believe the first step in teaching Bitcoin shouldn’t be handing someone a cold or even a hot wallet.

It should be helping them understand the different types of custodians, how to assess their reputation, and preparing them to transition to self-custody once they’ve built up enough of a balance. Because real bitcoin is the goal—and everything else is just the road to that.

Is This the Future of Bitcoin… Centralized Custodians?

What if Bitcoin ends up centralizing, just like gold did?

Over time, gold left the hands of the public and became the domain of giant banks and clearing houses, which eventually stopped holding and redeeming physical gold altogether.

Today, only central banks settle in real assets, while everyone else is exposed to layers of rehypothecated IOUs and compounded counterparty risk that grows with every intermediary.

But Bitcoin is different. Bitcoin custodians can still hold and settle actual BTC instantly. They operate as sovereign verifiable entities on the Bitcoin–Lightning Network, minting and burning large volumes of IOUs globally at ultra-high frequency.

Unlike the fiat system, where trust in layers is unavoidable, Bitcoin users retain the power to exit—one transaction away from full self-custody.

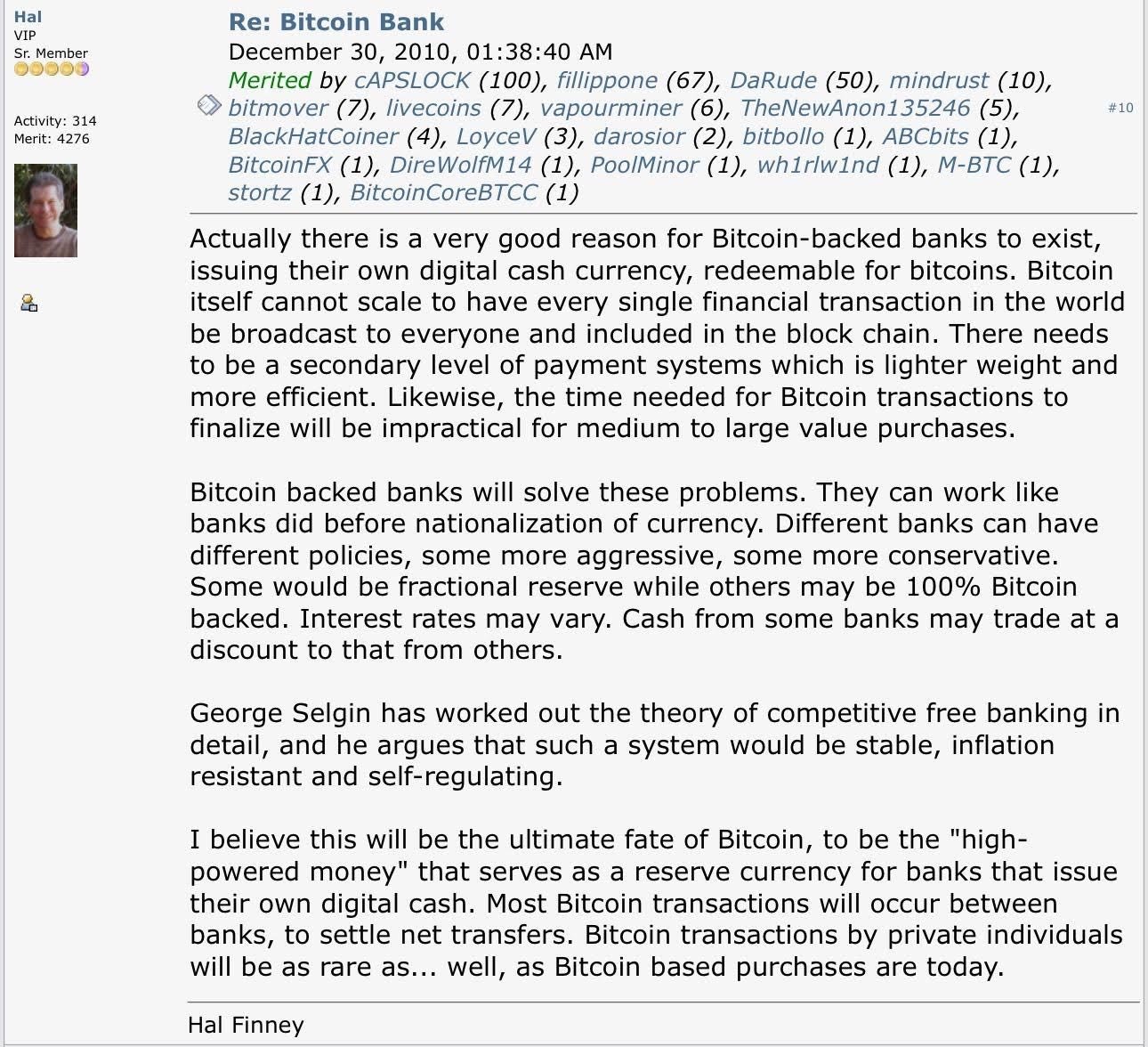

As Hal Finny put it:

So while it’s crucial to keep advancing self-custodial solutions, we shouldn’t be quick to trash custodians who actually offer reliable services and we need more of them. They’re not the enemy—they’re often the gateway that helps people dip their toes into Bitcoin before they’re ready to swim on their own.